Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Monthly

$9.99

Auto-renews monthly

Annual

$99.00

Lock in your annual rate

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Monthly

$9.99

Auto-renews monthly

Annual

$99.00

Lock in your annual rate

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

In 2025, it’s time for stern resolve and bold maneuvers.

This year has reshaped the political landscape of climate action in ways few could have predicted. From the European Parliament to the US presidency, elections have upended the alliances and leadership structures that have traditionally driven climate progress. A world that as recently as 12 months ago thought it could rely on Europe as the steady hand of global leadership now finds the continent politically fracturing. Across the Atlantic, the United States is once again charting an unpredictable course, although one that will certainly take it further from sensible climate policy, while China continues to lead through industrial dominance rather than diplomatic consensus. It is, to put it mildly, a less-than-ideal setting for tackling the most pressing issue of our time.

Europe’s political shifts may be the most concerning. On the surface it appears the continent’s commitment to climate has held, but underneath tensions are boiling. Once a bastion of ambitious climate policy, the European Union is now grappling with internal instability that risks derailing its leadership.

The EU Commission president’s centrist party remains in power after parliamentary elections, despite rising pressure from the far right and with its commitment to the Green Deal agenda intact. However populist forces — recently represented by farmer backlash to environmental policy — leaves them focused on defending Europe’s existing commitments, rather than driving its next iteration.

In the member states things look more challenging. Italy’s ruling government is openly challenging Europe’s commitment to electric vehicles. In France the spectre of a broad anti climate agenda headlined by once unthinkable notions like a power sector “Frexit” pushed by the country’s right wing was held at bay after parliamentary elections this summer that avoided a far right shift. But a recent no confidence vote on the coalition government’s short-lived prime minister Michel Barnier means that an anti climate agenda from one of the largest and most influential member states is a very real possibility.

And in Germany, the industrial heart of the European Union and its most influential member state, a populist backlash fueled by a stagnating economy included anger over heat pump mandates and has forced the ruling coalition to dissolve and bring elections forward to February. Most observers now believe it’s not a question of whether far-right climate-denying parties will increase in influence, but by how much.

These developments signal that Europe is at a crossroads, and while it may still have a seat on the climate train, it is no longer guaranteed to be in the conductor’s seat.

As Europe falters, attention inevitably shifts to China. The country’s transformation into a clean energy superpower is undeniable — it already dominates solar and battery manufacturing, and has now turned its focus to electric vehicles. Yet China is unlikely to fill Europe’s diplomatic void. Its approach to climate leadership is less about setting global standards and more about demonstrating what’s possible. This isn’t a case of "do as I say" but rather "do as I do.” While this may lead to trade wars and industrial rivalries, it could also send a powerful signal to the rest of the world: Clean energy isn’t just the future — it’s worth fighting for.

Ultimately, the geopolitical shifts of 2024 are a wake-up call for the climate community. What appeared to be lasting policy breakthroughs decades in the making now feel more tenuous. Populist backlash opens hard questions about how climate action can find a broader, more durable base of support. More existentially, the community is left wondering how we build those conditions on a vanishingly short time frame amidst the uncertainty political changes are unleashing.

What is clear is that the playbook that worked in the past will not suffice in this fractured, volatile world. Climate policy simply must become more resilient to political swings by broadening its base of support across the political spectrum in Europe and beyond. That not only makes policy more durable, it also isolates climate denial to the political fringe, and focuses debates on how — not if — we take action.

There is reason to hope such steps are possible. Recent U.S. examples, such as the 18 members of Congress who called for preserving certain investment provisions in the Inflation Reduction Act, demonstrate that climate action can find firmer ground even in a hostile environment. That support was driven by economic opportunity that can defy the gravity of political polarization. There are now millions of people across the political spectrum who own a piece of the clean energy transition, be it a solar home system, an electric vehicle, or a job in a clean energy company. Organize that constituency across party lines, and the politics will follow.

At the same time, the clean energy industry must step up. For all its economic success, it remains politically underpowered. Researchers Robert Brulle and Christian Downie found that from 2008 to 2018, trade associations opposed to climate action outspent climate-positive industry groups by a ratio of 27 to 1. This is neither serious nor sustainable. If clean energy is to cement its place as the backbone of the global economy, it must take greater responsibility for its political future. Industries that shape policy don’t wait for others to speak on their behalf — they do it themselves.

And then there’s the culture. As much as policy matters, culture shapes what policies are possible. To win back the narrative, the climate movement must move beyond technical white papers and elite op-eds focused on rational persuasion to cultural elites. Instead, it needs to create stories that resonate deeply with people’s values and aspirations. Whether that’s through TikTok videos, podcasts, or new forms of media, the goal must be to inspire and connect, not just to educate.

Regardless of the strategic pivots we make, the hard truth is that climate politics may get worse before they get better. Feedback loops — both environmental and political — can drive crises in unexpected ways. Populist backlashes and extreme weather could force governments to retreat into short-termism with key elections looming, making it more difficult to focus on the long view. Or they could combine to give the climate conversation a political salience it has never before had to exploit.

The climate movement has faced existential challenges before and emerged stronger. But no outcome is inevitable, making the strategic choices before us now truly pivotal when the stakes couldn’t be higher. Now is the time to make some bold ones, because our future depends on it.

Justin Guay

Justin Guay is a program director at Quadrature Climate Foundation. Previously he was the director for global climate strategy at the Sunrise Project. He has 15 years of experience in nonprofit advocacy and strategy development working for ClimateWorks Foundation, Packard Foundation, and the Sierra Club.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The central bank cut rates again, but that’s not the headline news.

The Federal Reserve cut interest rates at its third straight meeting — but don’t expect as many cuts next year.

The Fed indicated that it expects only two quarter-point reductions in 2025,down from the four it had forecast in September, when it began its rate-cutting cycle. The news will likely overshadow any relief over lower rates for renewables developers, who have been counting on future cuts to ensure the profitability of their projects.

Since renewables like wind and solar have essentially no “fuel” costs compared to fossil fuel projects like gas-fired power plants, a higher portion of their overall costs must come from borrowed money, not from revenues the project itself produces. This makes the projects much more sensitive to borrowing costs.

The Energy Information Administration has projected that solar capacity will grow by 19.5% in 2025 and that wind capacity will increase by 6%. Wind projects, especially offshore wind projects, could be imperiled by higher interest rates and higher borrowing costs. The energy consulting firm Wood Mackenzie has estimated that a 2 percentage point increase in interest rates causes the price of energy produced by renewables to go up 20%.

Further pressure from inflation could also increase the cost of building out renewables. Several major offshore wind projects — such as New Jersey’s Ocean Wind 1 and 2, which were cancelled last year — have had to have their contracts renegotiated or even thrown out due to unexpected cost increases.

And despite the Federal Reserve interest rate cuts in the last quarter of the year, market interest rates have actually been drifting up in the past few months. Trump’s victory supercharged the stock market with promises of deregulation and general euphoria around tech stocks like Nvidia and Tesla (and crypto) and raised the possibility of higher inflation, with a potential combination of tax cuts, some spending increases, and tariffs.

Some analysts thought that even the Fed’s new rate-cutting forecast was too loose considering the economic data that has been arriving in recent months. “We have a hard time squaring them up against the economic forecasts, which show higher near-term growth, higher near-term inflation, and lower near-term unemployment,” Jefferies analyst Thomas Simons wrote in a note to clients Wednesday.

The new rate-cutting forecasts “amount to a message that the FOMC will tolerate above-target inflation for even longer than they previously indicated,” Simons wrote.

But what the market is focused on is that there may be fewer rate cuts than expected, not that there maybe should have been zero.

Over the past three months, the yield on the 10-year Treasury bond, an often-used benchmark for borrowing costs, has risen from around 3.7% to 4.5%, including a substantial jump following the Fed’s Wednesday announcement. Longer-term interest rates have risen “quite a bit since September,” Federal Reserve chair Jerome Powell said in a press conference Wednesday.

The iShares Global Clean Energy ETF, which tracks a basket of clean energy stocks, fell immediately following the Fed’s rate cut announcement; it fell around 3% today and is down 26% on the year, while broader stock market indices also fell, with the S&P 500 declining just under 3% today

Powell said that both the cut and the new, more restrictive forecast indicate that the Fed is “in a new phase in the process,” and that “from this point forward, it’s appropriate to move cautiously and look for progress on inflation.”

On a new IEA report, EV batteries, and some good news about emissions

Current conditions: Very windy conditions in the UK have sent wind power generation soaring but electricity prices plummeting • Strong storms are expected to bring heavy rain and possibly tornadoes to Nashville, Tennessee • It’s cloudy in Tokyo, where Nissan shares were up on the news that the automaker is in merger talks with Honda.

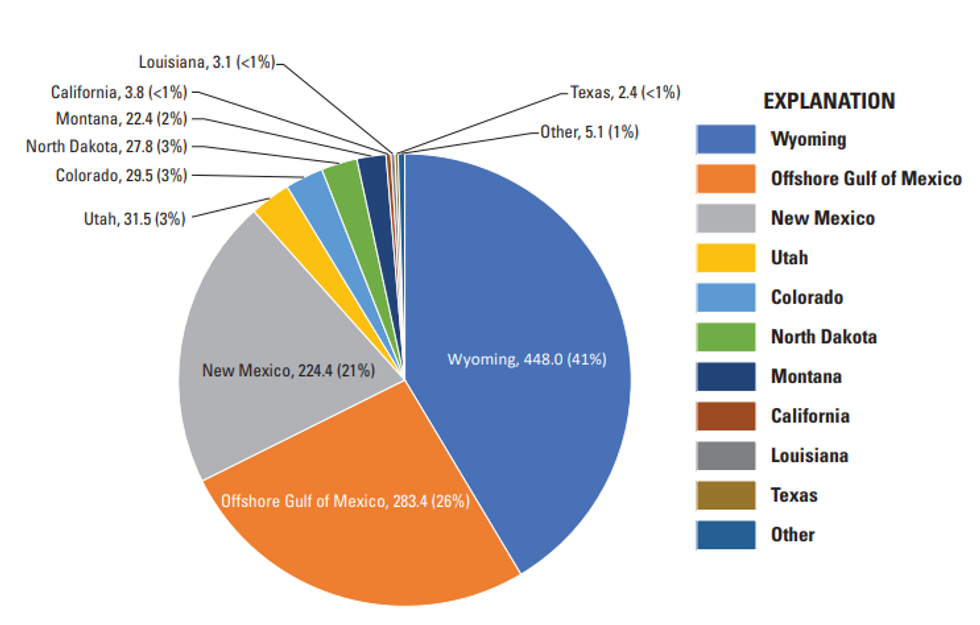

Greenhouse gas emissions from U.S. federal lands peaked in 2009 and have been mostly falling ever since, according to a report from the U.S. Geological Survey. Federal lands make up nearly 30% of all the nation’s land. In 2009, annual emissions from fossil fuel extraction and use on these lands reached 1,430.9 million metric tons of CO2 equivalent, but had fallen to 1,118.9 million metric tons in 2022. Emissions saw a particularly steep drop in 2020, likely linked to the pandemic, and have been rising, but it’s not clear if the upward trend will continue. Wyoming is a major emitter: Its federal land CO2 emissions in 2022 made up 41% of the national total.

The same report also found that natural ecosystems (like soil, vegetation, and deadwood) on federal lands are offsetting just 1.4% of the annual emissions, and that “climate conditions” like drought and wildfire have “resulted in a decline in the sink strength of ecosystems on federal lands.” For context, total greenhouse gas emissions for the U.S. have been falling – in 2022 they were down 3% from 1990 levels. Carbon dioxide emissions from federal lands make up about 22% of the U.S. total.

The Department of Energy’s Loan Program Office closed a loan yesterday to fund EV battery plants in Kokomo, Indiana. The $7.54 billion goes to StarPlus Energy – a joint venture between Samsung and Stellantis – and was approved as a conditional loan in early December. At the time it wasn’t clear whether the LPO would be able to finalize it before the Trump administration takes over. The DOE estimates the Indiana projects will create 3,200 construction jobs and 2,800 operations jobs, and the finished plants will produce 67 GWh of batteries, “enough to supply approximately 670,000 vehicles annually.”

The Department of Energy on Tuesday published the results of its analysis of the economic and environmental implications of expanding U.S. exports of liquefied natural gas. Among its key findings:

The main takeaway, according to an accompanying letter penned by the Secretary of Energy Jennifer Granholm, is that “a business-as-usual approach is neither sustainable nor advisable.” In a call on Tuesday, Granholm acknowledged that the future is in the next administration’s hands. “We hope that they’ll take these facts into account to determine whether additional LNG exports are truly in the best interest of the American people and economy,” she said.

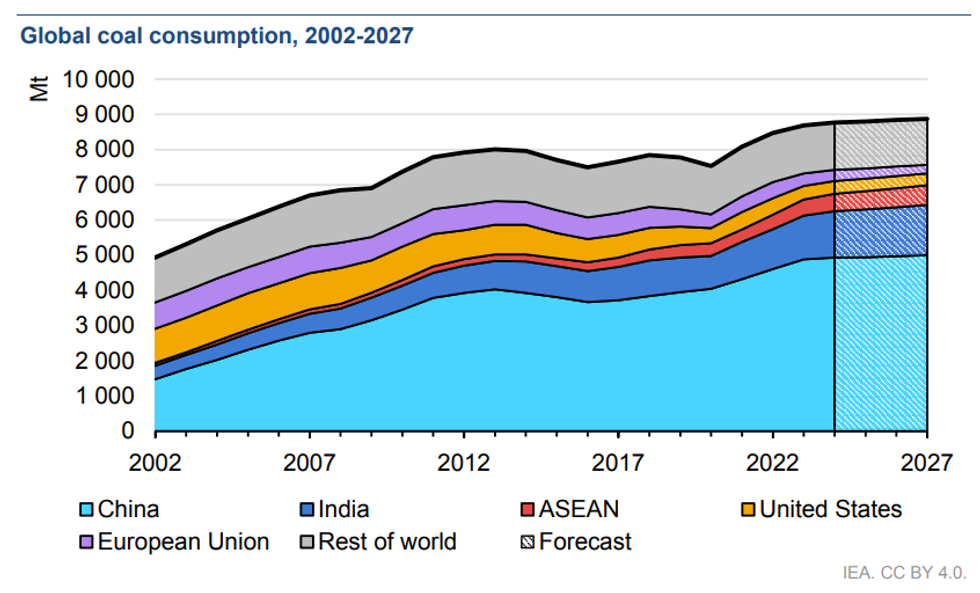

Global coal demand is set to rise to a new record this year and remain steady through 2027, according to the International Energy Agency. While the rapid rollout of renewables is encroaching on coal’s “century-long supremacy in electricity generation,” soaring power demand is counterbalancing this trend and giving coal a boost, the IEA said in its Coal 2024 report. The future of coal will depend largely on what happens in China, the largest consumer of the world’s dirtiest fuel. This year China, India, and countries in Southeast Asia are projected to account for 75% of global coal demand.

A new analysis from hundreds of researchers across the world recommends that we stop treating our most pressing global problems as being separate from one another, and instead acknowledge they’re all connected. Solving them will require a holistic approach. Climate change, biodiversity loss, water shortages, food insecurity, and health risks are all interlinked, the assessment says, and decisions to address these challenges should be coordinated to “maximize synergies and minimize trade-offs.” Right now, humanity is looking at these issues in isolation, “resulting in potential misalignment, unplanned trade-offs, and/or unintended consequences.”

Last month some of the leading voices on global climate science and policy penned an open letter calling for negotiators at future COP climate summits to consider the interconnected issues of nature loss, inequality, and poverty to ensure meaningful solutions. The new report was published by the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services.

Virginia will become home to the world’s first commercial fusion power plant. The facility will be operated by Commonwealth Fusion Systems, and is expected to produce enough energy to power about 150,000 homes sometime in the early 2030s.

Five years from the emergence of the disease, the world — and the climate — is still grappling with its effects.

Five years ago this month, the novel coronavirus that would eventually become known as Covid-19 began to spread in Wuhan, China, kicking off a sequence of events that quite literally changed the world as we know it, the global climate not excepted.

The most dramatic effect of Covid on climate change wasn’t the 8% drop in annual greenhouse gas emissions caused by lockdowns and border closures in 2020, however. It wasn’t the crash in oil prices, which briefly went negative in April 2020. It wasn’t the delay of COP26 and of the United Nations Intergovernmental Panel on Climate Change’s Sixth Assessment Report. And it wasn’t, sadly, a legacy of green stimulus measures (some good efforts notwithstanding).

Rather, it was in the way the world’s governments (especially the largest and most powerful) responded to the virus, which undermined the very idea of multilateralism, climate action included. This took place along three main vectors: inertia on global financial rules, even as long-acknowledged failings turned catastrophic; a renaissance in industrial policy that may prove transformative for domestic fiscal policy; and, at the intersection of both, deterioration of what we might call geopolitics or “global solidarity.”

Evidence of this phenomenon can be found in nearly every aspect of the global order. The World Bank in October pointed to Covid as chief among a “polycrisis” of “multiple and interconnected crises occurring simultaneously, where their interactions amplify the overall impact.” Development gains have almost slowed to a halt. Extreme poverty has increased overall in low-income countries since 2014, after decades of improvement, according to the World Bank’s analysis.

None of this, however, was an inevitable effect of Covid. Poor countries got poorer, for the most part, because of norms and hard rules in global finance that they have little control over — what a group of researchers last year termed “financial subordination.”

To understand why, a brief history: Developing countries during the 2010s were seeking new avenues of finance as traditional sources like multilateral development bank loans, official development assistance, and commercial bank loans waned. Many turned to the U.S. dollar sovereign bond markets, and also to China; a few countries also turned to commodity traders like Glencore and Trafigura, taking on opaque debts to be repaid with their own oil and other commodities.

When the pandemic response shut down many kinds of economic activity in 2020, what World Bank researchers called a “fourth wave” of debt followed. After a continuous series of debt surges from 1970 to 1989, 1990 to 2001, and 2002 to 2009, global debt markets had been relatively stable for the preceding decade. What was different about this fourth wave was that it was largely in developing countries.

With Covid, the fourth wave turned into a tsunami. Countries everywhere were paralysed by the pandemic, but the poorest ones lost critical revenue from tourism, remittances, and some exports. On top of that, they suffered the same lockdowns and illness that depressed local economic activity and drained government budgets in many countries. Unlike rich countries, developing countries had limited ability to dip into reserves or raise money from the bond markets to keep their citizens safe and tide over those who lost work.

Wealthy countries and lenders did little to ameliorate this stress. A “Debt Servicing Suspension Initiative” facilitated by the G20 provided some relief for 46 countries; China participated, too, granting deferrals to some of its debtor countries. But private bondholders (who were earning returns as high as 9%) and multilateral banks did not. The debts still had to be paid, and by 2023, aggregate net capital flows were negativefor developing countries — that is, more money flowed from poorer countries to richer ones than the other way around.

Numerous governments defaulted on their debts in the wake of Covid, including Ghana, Sri Lanka, Zambia, Ethiopia, and Suriname. But perhaps just as bad, many, many more countries continued to pay their debts by slashing their health and social welfare budgets just as they were needed most. Low- and middle-income countries spent more on debt servicing in 2022 than they spent on health in 2020, during the height of the pandemic.

Tensions between the U.S. and China, meanwhile, became even more overt around Covid, helped in part by accusations and recriminations over the source of the disease. The two great powers were themselves deeply changed. China emerged from its Covid Zero measures with public discontent at a nearly unprecedented pitch and its engines of economic growth — domestic infrastructure and residential property — faltering as vast local government debts became unmanageable. The country’s central government renewed its focus on an export-led growth model, but this time instead of cheap, low-tech consumer goods, it was semiconductors, solar panels, and electric vehicles.

It quickly became clear that the Biden administration would not be much less hawkish towards China than Trump’s was. It largely focused inwards, on tackling the disenfranchisement of formerly solid Democratic working class constituencies that Trump had exploited and Covid deepened. These were largely seen as an outcome of untrammelled free trade — especially with China. But Covid lockdowns and the rush to regain normalcy in the re-opening choked complex supply chains and logistics networks, driving up prices around the world and helping to spark a global inflation crisis that has yet to meaningfully abate in many parts of the world.

When Russia invaded Ukraine, energy prices shot up, particularly in those countries reliant on imported oil and natural gas. This shook the global fossil energy economy. Exports of liquified natural gas by the United States to Europe skyrocketed, as European countries desperately sought alternatives to Russian piped gas. Those same desperate Europeans also bought LNG shipments that had been bound for countries like Bangladesh and Pakistan, outbidding the poorer countries which then endured blackouts and further hits to their financial reserves as they struggled to match the new EU price.

Global energy price rises compounded the Covid supply-chain pressures and monetary policymakers decided hiking interest rates was unavoidable. While Russian troops tried to capture Kyiv in March of 2022, the U.S. Federal Reserve — perhaps the most powerful U.S. entity for the rest of the world — began hiking interest rates, taking them from just a quarter of a percent before the invasion to more than 5% by mid-2023. This strengthened the U.S. dollar, heaping more pressure on developing countries trying to pay dollar-denominated debts. Meanwhile, in rich and poor countries alike, the jump in living costs has helped drive backlashes against incumbents, and a surge in far-right populism.

Perhaps years ago, if we’d known that we’d see a spike in temperatures, droughts, and storms alongside a flood of cheap solar panels and EVs, technological breakthroughs in batteries, and a renewed interest in industrial policy, it might have seemed that more urgent climate action was assured. Instead, divisions have worsened. The agreement text from this year’s United Nations climate conference is actually slightly watered down from the last year’s statement on fossil fuel phaseout. A special conference on biodiversity Cali, Colombia, finished last month only when delegates had to catch flights home, and a desertification conference hosted by Saudi Arabia finished this month with no group statement.

Rachel Kyte, the UK special envoy for climate change, told an event hosted by the Overseas Development Institute think tank that even as it approached its 10-year anniversary, the 2015 Paris Agreement was more fragile than it had ever been. Countries like the UK, she said, had been inflicting “paper cuts” on developing countries for so long that the ill will was becoming impossible to wave away.

“[W]e’ve also cherry-picked which international laws we want to stand behind and then, which conflicts we believe the international law is important for and not,” she added. “And you sit in the climate negotiations and they know that you know that they know that you know.”

And yet a hopeful note sounding out of all of this has been the central role of clean energy in many countries’ responses to the increasingly fractious global landscape. Responses to Covid, as chaotic as they were, demonstrated that governments can take decisive action. Although the vast majority of Covid stimulus was climate-neutral at best; about a trillion dollars’ worth of investments really were green. Efforts to boost cycling gained ground in some cities, including in Paris, where bike trips now outnumber car trips in and around the city center.

Renewed interest in energy security sparked by the Ukraine invasion has been largely supportive of clean energy. Europe’s combined wind and solar generation rose 10% in the first year after the invasion as the bloc made its emissions reduction target more ambitious. Green industrial policy introduced by the Biden administration has encouraged other countries to see decarbonization as a competitive opportunity rather than an obligation. And China’s doubling down on its manufacturing of the “new three” — batteries, EVs, and solar panels — has created an oversupply that spurred rapid uptake of clean energy in many countries.

Fractures, however, are rife. Too many countries have steep tariffs on clean energy imports preventing them from taking advantage of cheap Chinese components, adding to other barriers to clean energy generation, such as the restrictive planning rules in Japan, where renewable energy generation lags; even wind power, where the country has ample potential, was virtually flat for the decade to 2022. Tariffs on imports to the U.S., while helping to build a domestic industry, also slow the rate of deployment. Globalized supply chains tend to be cheaper; a study in Nature estimated that they saved the U.S. up to $31 billion in the 12 years leading up to 2020, while China saved up to $45 billion, compared to a scenario in which domestic suppliers were prioritized. Even with its rapid expansion in clean tech manufacturing thanks to the Inflation Reduction Act, it will take years for the U.S. to catch up to China’s capabilities, while in the meantime, tariffs will slow down installations.

For those in wealthier and more powerful countries, there’s at least a chance of political shift. For countries under financial subordination, there are hard limits to what can be achieved.

Geopolitical alignment is an increasingly sensitive question for countries trying to avoid the pitfalls of appearing to be too close to either China or the U.S. Auto manufacturing has become the site of intense competition and tension, with the U.S. and EU putting punitive tariffs on Chinese EV imports to compensate for “state subsidies.” The introduction of the European carbon border adjustment mechanism this year, which penalizes high-carbon imports so they don’t undermine the continent’s carbon pricing regime, has introduced a new source of tension around trade, particularly for African countries that rely on exports to Europe and are nowhere near having their own carbon accounting scheme that is a prerequisite to avoiding the surcharges.

We may only know in retrospect, but the supply bottlenecks and inflationary surges associated with the Covid lockdowns and reopenings may have been a kind of masked transition phase into a new, more permanently supply-constrained world. Researchers at Potsdam Institute and the European Central Bank published new research in March showing that climate change impacts will raise general inflation by more than a percentage point by 2035.

The damage could be seen in the recent COP29 in Azerbaijan. Trust was close to an all-time low over negotiations for a new target for finance flows from wealthy to poor countries. After it ended with a controversially low $300 billion target, Fiona Harvey of the Guardian called it the second worst COP of the 18 she’s attended, surpassed only by the disastrous 2009 COP15 in Copenhagen, which ended with no agreement at all. It can also be seen in the rebound in emissions since 2021.

While some hopeful shifts have emerged from the Covid era, the increasingly febrile global atmosphere risks endangering our already slim chances of protecting the habitable atmosphere. As climate impacts worsen, pushing back on that axiom will be more difficult, but more urgent. Combating climate change is such a monumental undertaking that collaboration – in technology, manufacturing, knowledge, and diplomacy – will be vital.